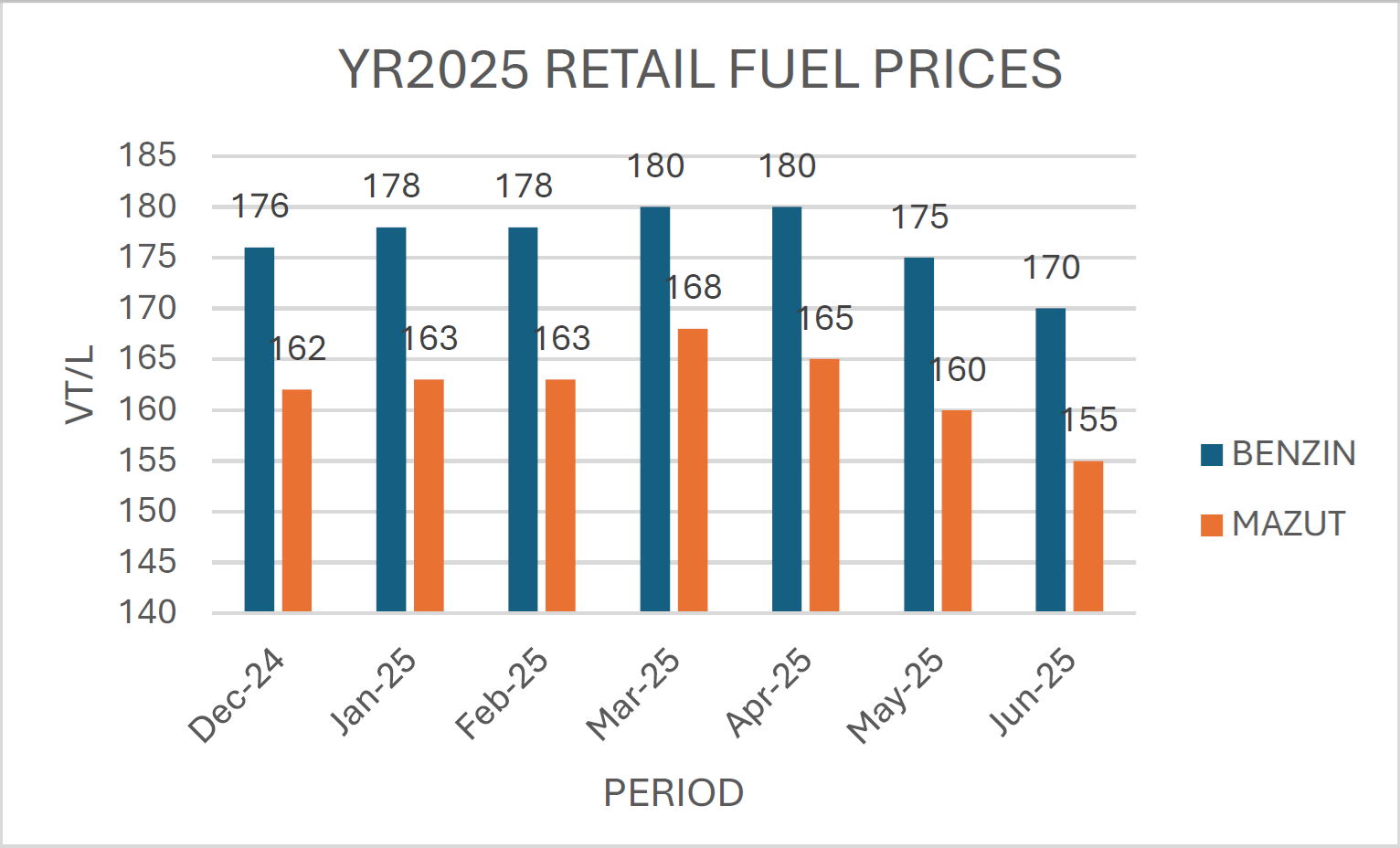

Vanuatu Retail and Wholesale Petrol and Diesel Prices 7th April 2025

The retail petrol (Mogas) prices show a slight increase by +4VT/L over the last 5 months (December 2024 to April 2025). The retail mazut (ADO) price was 162 VT/L in December 2024 and is up by +3 VT/L to 165 VT/L in April 2025. As of April 2025 the retail price of petrol is at 180 VT/L while the wholesale price is at 167 VT/L. For diesel, in April 2025, the retail price is 165 VT/L and the wholesale price is at 152 VT/L.

Fuel price commentary

Crude oil prices continued to increase gradually, trading between USD 80-87/bbl in August. Oil prices increased in August because Saudi Arabia and Russia extended voluntary crude oil product cuts through September and global oil stocks were at their lowest level since December 2022, putting upward pressure on prices. For the monthly average, Dated Brent was at USD 85.06/bbl (6% higher than July).

Crude oil prices extended their gains in August, supported by economic growth and an increase in refinery intake, particularly in US and China. The OPEC+ and Russia production cuts tightened supply of heavier crude oil, which contributed to a sharp increase in refining margins as refineries had to run lighter crudes than ideal, restricting product make particularly for diesel. China, India, and other Asian countries also supported product demand during the summer travel season. The healthy demand from Asian buyers supported both crude and product prices during August.

While the crude oil price rose for the August month average compared to July, product prices jumped, rising much more than crude particularly for jet and diesel. Petrol refining margins have risen to levels seen in January this year, driven by tighter product supply as delays in product export quotas limited product supplies from China into the Asia-Pacific region.

Regional diesel prices surged with higher crude and stronger refining margins. Favourable shipping economics for exporting out of the region to Europe, refineries coping with a lighter crude mix than ideal, and delays in Chinese export quotas tightened diesel supplies. These factors have driven diesel refining margins to an eight-month high as well. Regional jet/kerosene prices were similar to diesel with sharp increases. Chinese refiners have exhausted their jet export quotas, which could slow down exports into the region and tighten supplies.

Maritime freight rates improved in response to increased activity in the Asia-Pacific region supported by economic growth, particularly in India. These factors combined have resulted in a large increase in all product prices.

Price Outlook

Crude oil prices increased over USD 90/bbl last week, the highest level since November 2022. This is following Saudi Arabia and Russia’s September 5 announcement to extend their voluntary production cuts through the end of this year. Global oil inventories are expected to fall over that period, adding upward pressure on oil prices.

Product prices are increasing faster than crude and if they continue to rise, we expect Vanuatu pump prices to increase again next month.

Source: Shakil Kumar, Energy Advisor, Envisory (H&T)